The United Kingdom’s FTSE 100 index recently closed lower, impacted by weak trade data from China, highlighting the interconnectedness of global markets. In this environment, identifying high-growth tech stocks can be crucial for investors looking to navigate economic uncertainties and capitalize on innovative sectors.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Filtronic | 21.83% | 34.03% | ★★★★★★ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

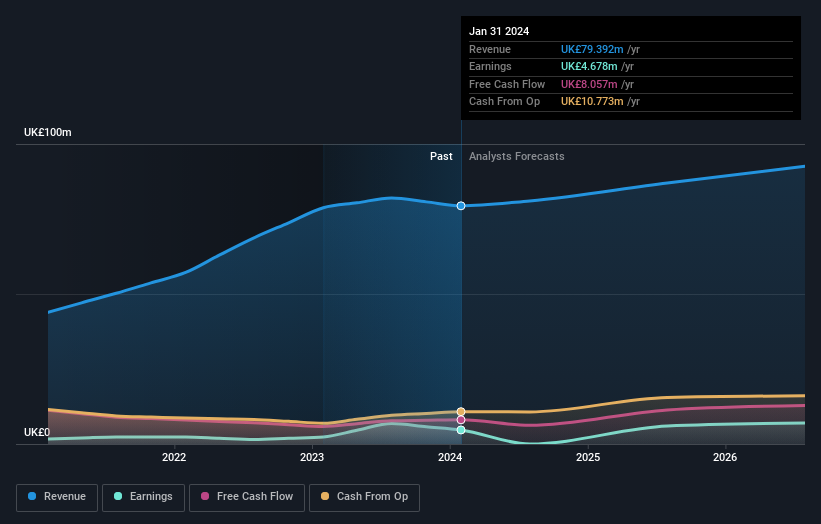

Overview: Craneware plc, with a market cap of £796.94 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc specializes in creating and providing software solutions tailored for the healthcare sector in the United States. The company generates revenue primarily through software licensing and support services.

Craneware, with a robust earnings growth of 26.8% over the past year, outpaced the Healthcare Services industry’s 8%. The company’s revenue is forecast to grow at an annual rate of 8.2%, surpassing the UK market’s average of 3.8%. A notable R&D expenditure focus ensures continuous innovation; recent collaborations with Microsoft Azure highlight this commitment, aiming to enhance their Trisus platform and AI capabilities. With net income rising from $9.23 million to $11.7 million and basic EPS increasing from $0.263 to $0.335, Craneware demonstrates solid financial health and strategic growth potential through acquisitions and partnerships in the healthcare sector.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tracsis plc, along with its subsidiaries, offers software and hardware solutions as well as data analytics/GIS services for the rail and transportation sectors, with a market cap of £213.88 million.

Operations: Tracsis generates revenue through two primary segments: Rail Technology & Services (£34.59 million) and Data, Analytics, Consultancy & Events (£44.80 million). The company focuses on providing specialized software and hardware solutions along with data analytics services for the rail and transportation industries.

Tracsis, a leader in transportation software and services, has demonstrated impressive earnings growth of 99.1% over the past year, significantly outpacing the Software industry’s 16.2%. The company’s forecasted annual earnings growth stands at an impressive 40.6%, well above the UK market average of 14.3%. With an R&D expenditure focus that saw £8 million invested last year to enhance its AI-driven solutions, Tracsis is positioned to leverage innovations in transportation analytics and optimization for continued expansion.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.04 billion.

Operations: Informa generates revenue through four main segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates across various regions, including the United Kingdom, Continental Europe, the United States, and China.

Informa’s revenue is forecasted to grow at 6.7% annually, outpacing the UK market’s 3.8%. Despite a recent 11.3% earnings decline, future projections indicate a robust annual growth of 21.5%, significantly above the market average of 14.3%. The company has invested £338.9 million in share buybacks from January to June 2024, enhancing shareholder value by repurchasing over 41 million shares, representing approximately 3% of its total shares outstanding.

Summing It All Up

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com