As the FTSE 100 and FTSE 250 indices experience declines amid weak trade data from China, investors are increasingly cautious about global economic conditions. In this uncertain environment, identifying high-growth tech stocks in the United Kingdom becomes crucial for those looking to capitalize on innovation and resilience.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.30% | 29.79% | ★★★★★☆ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Seeing Machines | 24.07% | 93.93% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £810.92 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: The company generates revenue primarily from its healthcare software segment, which accounts for $180.56 million. It focuses on developing, licensing, and supporting computer software tailored to the U.S. healthcare industry.

Craneware’s recent collaboration with Microsoft Azure promises to enhance its Trisus Platform, leveraging advanced AI and data analytics. This partnership aims to drive innovation and cost efficiency, particularly through the Microsoft Azure Consumption Commitment (MACC) agreement. With revenue forecasted to grow at 6.7% per year, outpacing the UK’s market average of 3.7%, Craneware’s earnings are expected to surge by 29.4% annually, significantly faster than the broader UK market growth rate of 14.3%.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LBG Media plc is an online media publisher operating in the United Kingdom, Ireland, Australia, the United States, and internationally with a market cap of £266.58 million.

Operations: LBG Media plc generates revenue primarily from its online media publishing activities, amounting to £67.51 million. The company operates in multiple regions including the UK, Ireland, Australia, and the US.

LBG Media’s earnings are projected to surge by 43.8% annually, significantly outpacing the UK market’s average growth of 14.3%. Despite a challenging year with a one-off loss of £4.2M, the company anticipates robust revenue growth at 11.7% per year, surpassing the broader market’s 3.7%. With R&D expenses contributing to innovation and development in their digital media platforms, LBG Media is positioning itself for substantial future gains within the tech landscape in the UK.

Simply Wall St Growth Rating: ★★★★★☆

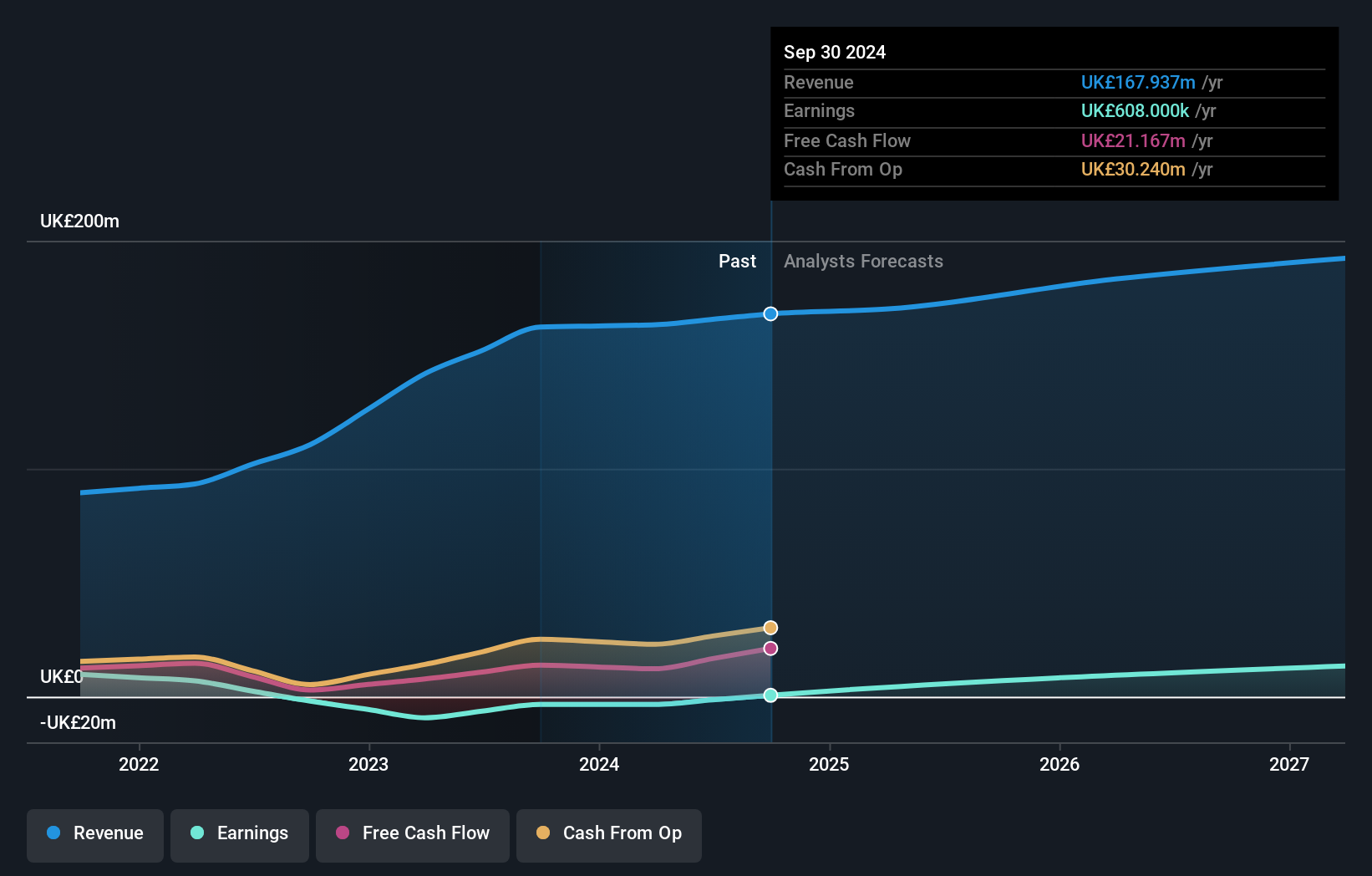

Overview: Redcentric plc offers IT managed services to both public and private sectors in the United Kingdom, with a market cap of £217.22 million.

Operations: Redcentric plc generates revenue primarily through the provision of managed IT services to customers, amounting to £163.15 million. The company serves both public and private sectors within the United Kingdom.

Redcentric’s revenue grew by 15.17% to £163.15M, while its net loss narrowed to £3.44M from £9.25M last year, indicating significant operational improvements. With R&D expenses contributing to their innovative cloud and managed services offerings, the company is expected to see a 63.8% annual profit growth over the next three years, outpacing the broader UK market’s average of 14.3%. Additionally, Redcentric’s forecasted revenue growth of 4.9% per year highlights steady progress in a competitive tech landscape where software firms increasingly adopt SaaS models for recurring revenue streams.

Key Takeaways

- Delve into our full catalog of 48 UK High Growth Tech and AI Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com