The United Kingdom’s FTSE 100 index has recently faced downward pressure, closing 0.4 percent lower at 7,527.42 amid weak trade data from China, indicating broader market challenges tied to global economic conditions. Despite these headwinds, high-growth tech stocks in the UK remain a focal point for investors seeking opportunities in sectors less impacted by traditional commodity and export fluctuations.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| M&C Saatchi | -14.20% | 43.75% | ★★★★☆☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £810.92 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware generates revenue primarily from its healthcare software segment, which accounted for $189.27 million. The company focuses on developing, licensing, and supporting software solutions tailored to the U.S. healthcare industry.

Craneware’s recent strategic collaboration with Microsoft Azure is set to enhance its Trisus Platform, leveraging advanced AI and data analytics. The company reported a 26.8% earnings growth over the past year, significantly outpacing the Healthcare Services industry at 9.3%. With an expected annual earnings growth of 25.6%, Craneware’s focus on M&A opportunities aligns with its strategy to expand expertise and customer base, as evidenced by its $189.27 million sales in FY2024 compared to $174.02 million in FY2023.

Simply Wall St Growth Rating: ★★★★☆☆

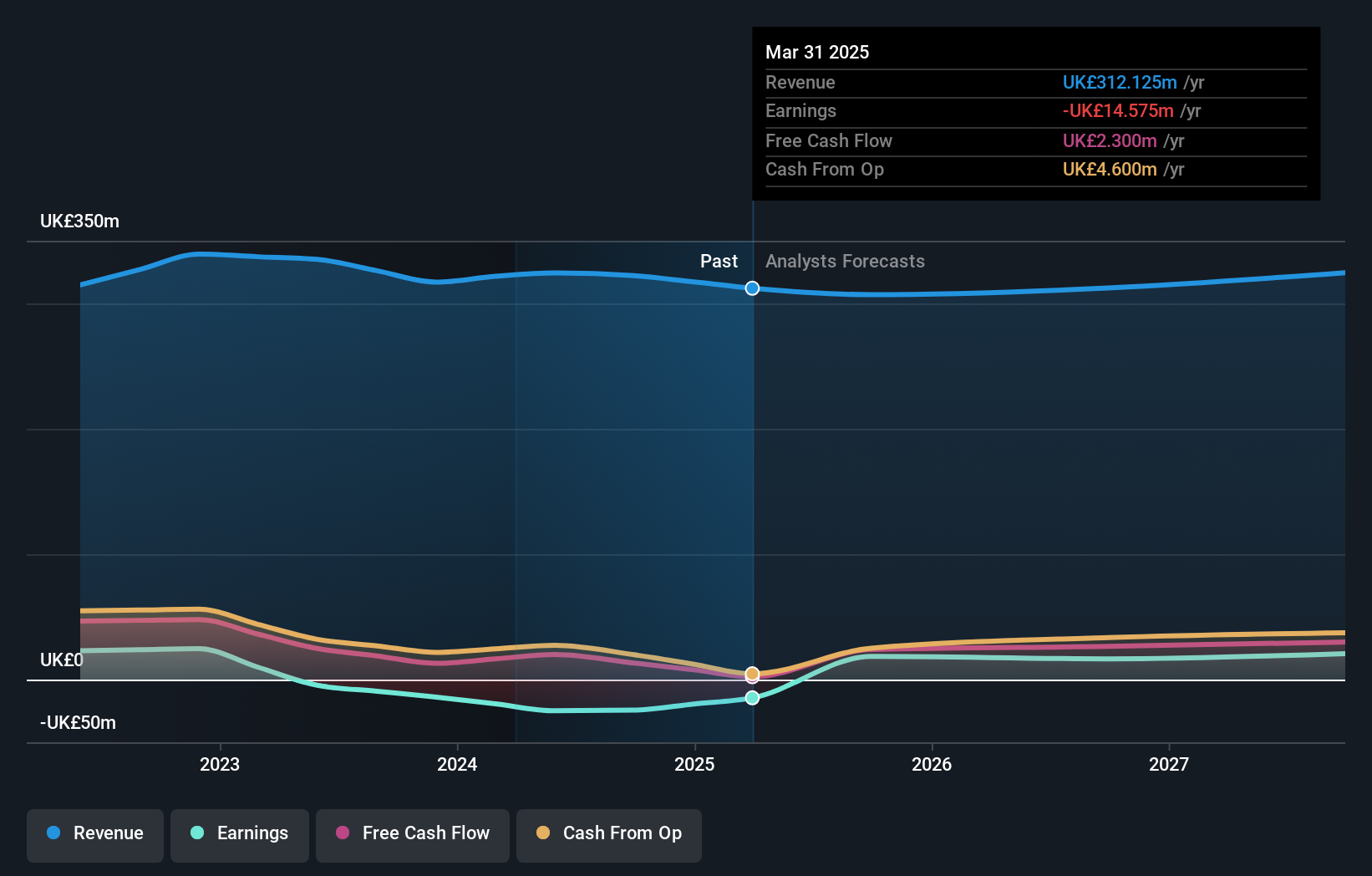

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.21 billion.

Operations: Genus plc generates revenue primarily from its Genus ABS and Genus PIC segments, with £314.90 million and £352.50 million respectively. The company operates globally across multiple regions including North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia.

Genus, a leader in animal genetics, has seen its earnings forecast to grow at 39.4% annually, significantly outpacing the UK market’s expected 14.4%. Despite a challenging year with net income dropping from £33.3 million to £7.9 million due to a large one-off loss of £47.8 million, its R&D expenses underscore commitment to innovation in genetic improvement technologies. The company’s revenue is projected to grow at 4.1% per year, slightly above the UK’s market growth rate of 3.7%, indicating steady progress amidst industry fluctuations.

Simply Wall St Growth Rating: ★★★★☆☆

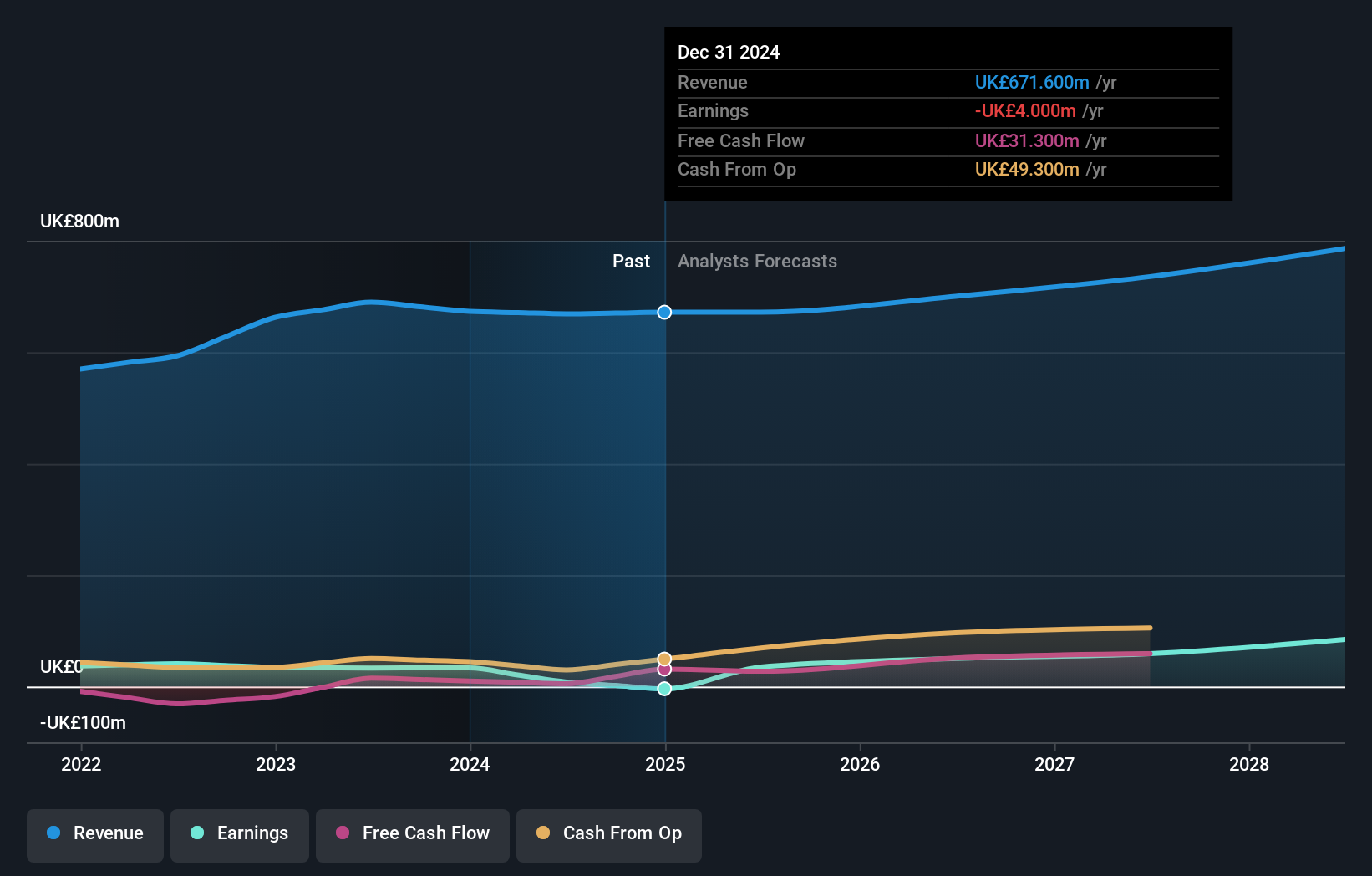

Overview: NCC Group plc operates in the cyber and software resilience sectors across the United Kingdom, Asia-Pacific, North America, and Europe with a market cap of £480.75 million.

Operations: NCC Group generates its revenue primarily from Cyber Security (£258.50 million) and Escode (£65.90 million) segments. The company operates across multiple regions including the UK, Asia-Pacific, North America, and Europe.

NCC Group, a cybersecurity and risk mitigation firm, has forecasted revenue growth at 4.5% annually, outpacing the UK’s market average of 3.7%. Despite reporting a net loss of £24.9 million for the year ending May 31, 2024, the company’s earnings are projected to grow by an impressive 87.1% per year over the next three years. This growth is supported by substantial R&D investments aimed at advancing their security solutions; in fact, they have allocated £20 million towards R&D in recent periods to bolster innovation and maintain competitive edge.

The company’s recent business expansions include constructing a new correctional facility in Mariestad with an additional SEK 250 million investment during Q2 2024 under its NCC Building Sweden segment. This strategic move aligns with their broader framework agreement with Specialfastigheter and underscores their capability in handling large-scale infrastructure projects amidst fluctuating market conditions. As software firms increasingly adopt SaaS models for recurring revenue streams from subscriptions, NCC’s focus on robust security measures positions them well within this evolving landscape.

Taking Advantage

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com