In the last week, the United Kingdom market has been flat, but over the past 12 months, it has risen by 6.7%, with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks that can capitalize on these favorable conditions is crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £803.93 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc generates revenue primarily from its healthcare software segment, which reported $189.27 million in sales. The company focuses on developing, licensing, and supporting software solutions tailored for the U.S. healthcare market.

Craneware, a UK-based tech firm, shows robust growth with revenue and earnings projections outpacing the market. Expected to grow revenues by 8.2% annually—faster than the UK’s 3.8%—and earnings by an impressive 25.6% per year, it eclipses the broader market’s 14.5%. This financial vigor is complemented by strategic moves like recent share buybacks totaling £5 million and active pursuit of acquisitions that align with its expansion goals in the U.S. healthcare sector. Moreover, a partnership with Microsoft enhances its offerings on Azure, integrating advanced AI to drive efficiencies in healthcare operations—a sector where it already impacts nearly 200 million patient encounters through its data insights.

This synergy between innovative tech solutions and strategic market positioning underpins Craneware’s potential in transforming healthcare efficiency and profitability. With R&D investments tailored to leverage emerging technologies such as AI within its Trisus platform, Craneware not only secures a competitive edge but also ensures sustainable growth amidst evolving industry demands.

Simply Wall St Growth Rating: ★★★★☆☆

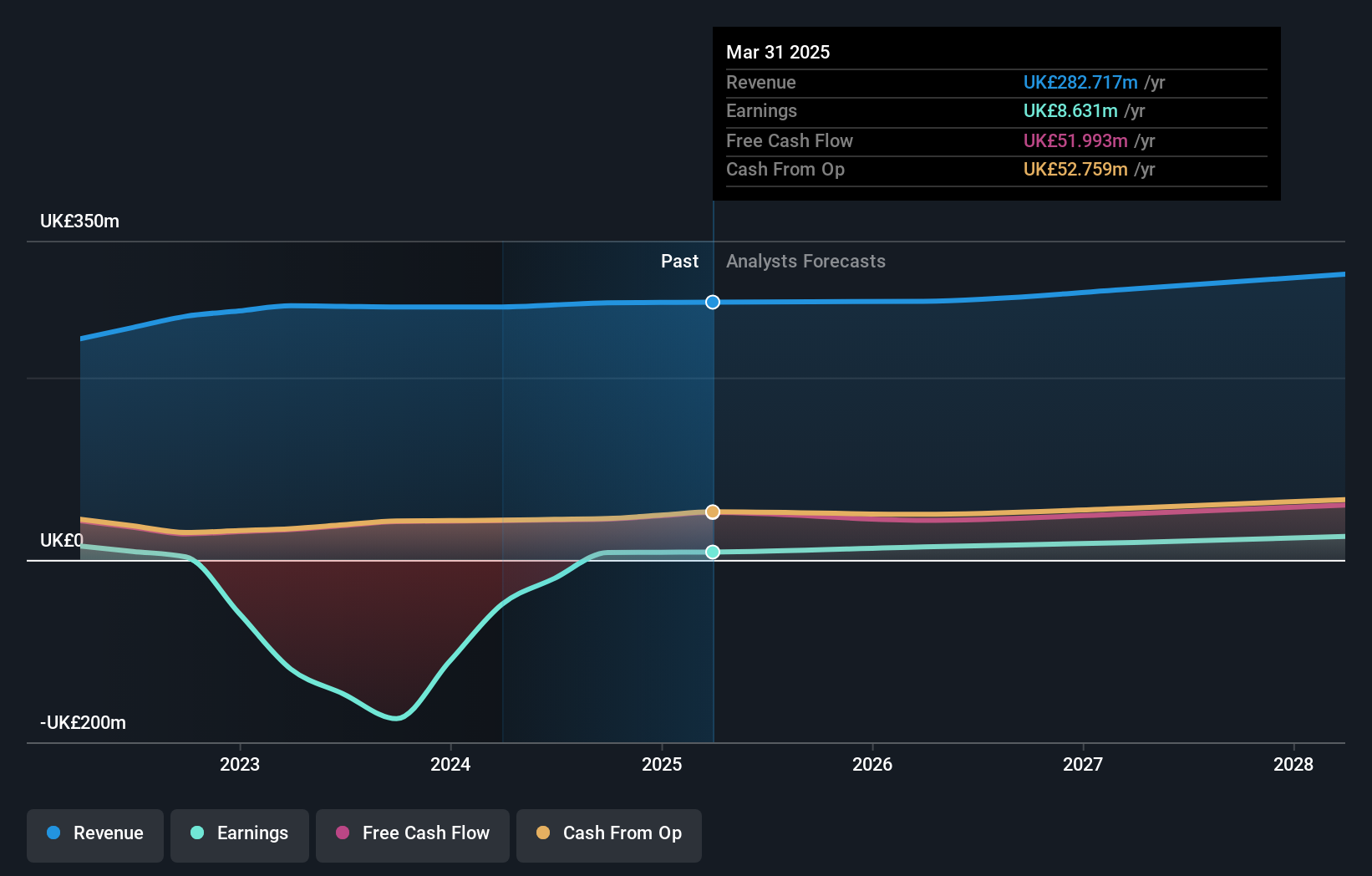

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and other international markets, with a market cap of approximately £799.20 million.

Operations: GB Group plc generates revenue primarily from three segments: Identity (£156.06 million), Location (£81.07 million), and Fraud (£40.20 million). The company operates in multiple international markets, including the United Kingdom, the United States, and Australia.

GB Group, navigating through a transformative phase, is poised to capitalize on the growing tech landscape in the UK. With revenue growth projected at 6.8% annually, it outpaces the broader UK market’s 3.8% expansion rate. This modest yet steady growth trajectory is complemented by an anticipated leap in profitability, with earnings expected to surge by a notable 92.9% per year over the next three years. Despite current unprofitability, GB Group’s strategic focus on enhancing its software solutions could position it favorably within its sector. The commitment is further evidenced by R&D investments aimed at refining and expanding its offerings—a crucial move as it transitions towards profitability and seeks to maintain relevance in a competitive industry.

Recent corporate actions underscore GB Group’s proactive stance; notably, a final dividend of 4.20 pence was declared at their latest AGM, reflecting confidence in future cash flows and stability despite ongoing investments in innovation and market expansion strategies such as potential acquisitions or partnerships that could bolster their technological edge and customer base diversification.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: S4 Capital plc, along with its subsidiaries, offers digital advertising and marketing services across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £258.09 million.

Operations: S4 Capital generates revenue primarily from three segments: Content (£608.70 million), Technology Services (£109 million), and Data & Digital Media (£199.20 million). The company’s market cap stands at £258.09 million.

S4 Capital, navigating a challenging landscape, reported a decrease in half-year sales to £422.5 million from £517.1 million year-over-year and reduced its net loss to £13.7 million from £21.8 million. Despite these hurdles, the company is poised for recovery with an earnings forecast promising an 83.7% growth annually, significantly outpacing the UK market’s 14.5%. This optimism is underpinned by strategic leadership changes aimed at harnessing AI-driven media solutions, as evidenced by the appointment of Linda Cronin as EVP, Head of Media at Monks, S4’s unitary brand focusing on innovative technology applications in marketing services—a move that aligns with industry shifts towards digital and AI-enhanced operations.

Turning Ideas Into Actions

- Take a closer look at our UK High Growth Tech and AI Stocks list of 47 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com