The United Kingdom’s market has recently experienced a downturn, with the FTSE 100 index closing lower following weak trade data from China, highlighting concerns over global economic recovery and its impact on UK companies tied to Chinese fortunes. In this environment, identifying high growth tech stocks in the UK requires focusing on companies that demonstrate resilience and adaptability amid fluctuating international demand and broader market uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 21.00% | 93.64% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, along with its subsidiaries, specializes in developing, licensing, and supporting computer software for the healthcare industry in the United States, with a market cap of £710.03 million.

Operations: The company generates revenue primarily through its healthcare software segment, amounting to $189.27 million.

Craneware’s strategic alignment with Microsoft Azure underlines its innovative approach in the healthcare tech sector, enhancing cloud-based solutions crucial for U.S. healthcare leaders. This partnership, highlighted by new entries in the Azure Marketplace, is set to boost operational efficiencies using AI-driven analytics. Financially, Craneware has demonstrated robust growth with a 26.8% increase in earnings over the past year and forecasts suggest an 8.2% annual revenue growth and a significant 25.6% rise in earnings annually, outpacing the UK market averages of 3.6% and 14.2%, respectively. These figures reflect not only Craneware’s strong market position but also its potential to leverage technology partnerships to sustain its upward trajectory.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.35 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million, respectively. These segments focus on animal genetics across various global regions, including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia.

Genus plc, navigating through a challenging year with a revenue dip to £668.8 million from £689.7 million, still projects an optimistic future with expected earnings growth of 39.4% annually. Despite a significant one-off loss of £47.4 million affecting the past financial year’s results, the company’s commitment to innovation is evident in its R&D expenditure which remains robust at 12% of total revenue, aligning with industry demands for continuous development in biotechnology. This strategic focus on research could catalyze its recovery and bolster its competitive stance in the high-tech landscape of the UK.

Simply Wall St Growth Rating: ★★★★★☆

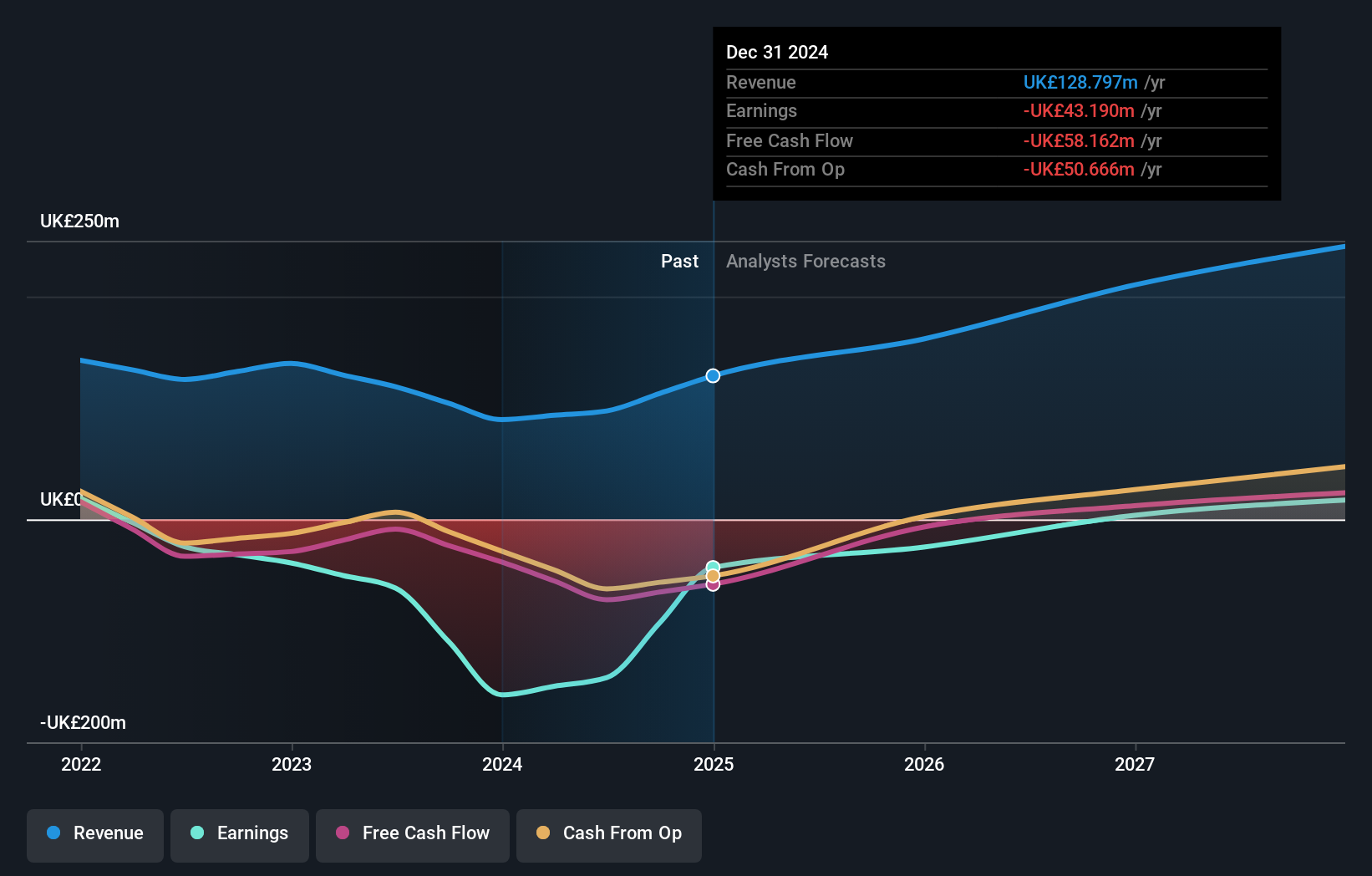

Overview: Oxford Biomedica plc is a contract development and manufacturing organization dedicated to delivering therapies globally, with a market capitalization of £405.57 million.

Operations: Oxford Biomedica generates revenue primarily from its Platform segment, amounting to £97.24 million. The company operates as a contract development and manufacturing organization focused on delivering therapies worldwide.

Oxford Biomedica, amidst a challenging landscape, shows promising signs with a projected revenue growth of 21% annually over the next three years, outpacing the UK market average of 3.6%. This optimism is bolstered by recent half-year sales rising to £50.81 million from £43.06 million in the previous year and a significant reduction in net loss to £32.49 million from £47.96 million. The company’s strategic emphasis on R&D is evident as it continues to innovate within the biotech sector, aligning its efforts with industry demands for advanced therapies and technologies. With new executive leadership under CFO Lucinda Crabtree and reaffirmed revenue guidance reaching up to £134 million for 2024, Oxford Biomedica is positioning itself strongly within high-growth tech spheres in the UK.

Summing It All Up

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com