Over the last 7 days, the market in the United Kingdom has dropped 1.0%, but it is up 7.1% over the past year with earnings expected to grow by 14% per annum over the next few years. In this dynamic environment, identifying high growth tech stocks that exhibit strong innovation and scalability can be crucial for investors looking to capitalize on future opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Trustpilot Group | 16.21% | 29.27% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Genus | 4.12% | 39.40% | ★★★★☆☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of £1.27 billion.

Operations: Genus plc generates revenue primarily from its Genus ABS segment (£314.90 million) and Genus PIC segment (£352.50 million). The company focuses on animal genetics across multiple regions, including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia.

Genus, a prominent player in the biotech sector, is experiencing significant earnings growth despite recent challenges. The company’s revenue is forecasted to grow at 4.1% annually, outpacing the UK market’s 3.7%. However, a substantial one-off loss of £47.8M impacted its financial results for the year ending June 30, 2024. Despite this setback, Genus’s earnings are expected to surge by 39.4% per year over the next three years, indicating robust future prospects.

The company has also demonstrated a strong commitment to innovation with substantial R&D investments; for instance, their R&D expenses accounted for £68M last year. This focus on research underpins their ability to deliver cutting-edge solutions in animal genetics and biotechnology sectors. Additionally, Genus proposed a final dividend of 21.7 pence per share for December 2024 payouts—consistent with previous dividends—reflecting confidence in its long-term strategy and shareholder value creation despite current profit margins dropping from last year’s figures (1.2% vs 4.8%).

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.12 billion.

Operations: Informa plc generates revenue through four main segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates across multiple regions, including the UK, Continental Europe, the US, and China.

Informa, a leader in the UK tech sector, is poised for substantial growth with earnings projected to rise by 21.5% annually, outpacing the UK’s market average of 14.4%. Despite a recent one-off loss of £213.5M impacting its financials for the year ending June 30, 2024, Informa’s revenue is forecasted to grow at 6.7% per year. The company has also repurchased over £1.3B worth of shares since March 2022 and continues to invest significantly in R&D to drive innovation and maintain competitive advantage in digital business solutions.

Simply Wall St Growth Rating: ★★★★☆☆

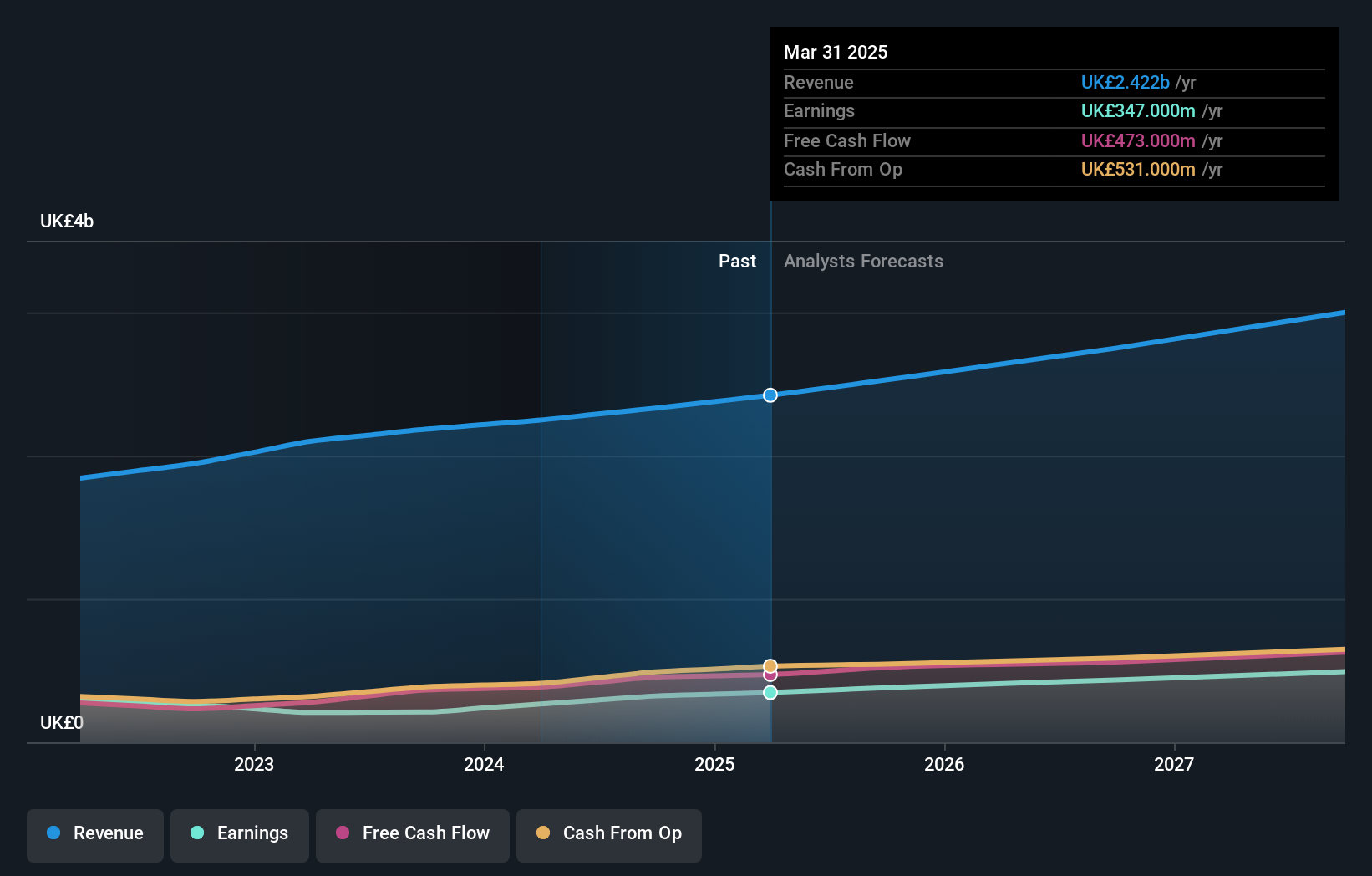

Overview: The Sage Group plc, together with its subsidiaries, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally, with a market cap of £9.95 billion.

Operations: Sage Group generates revenue primarily from its operations in North America (£1.01 billion), Europe (£595 million), and the United Kingdom & Ireland (£488 million). The company focuses on providing technology solutions and services tailored for small and medium-sized businesses across these regions.

Sage Group, a prominent player in the UK’s tech sector, has demonstrated robust growth with earnings increasing by 28.4% over the past year, significantly outpacing the software industry average of 16.2%. The company’s revenue is forecasted to grow at 8% annually, surpassing the UK market’s average of 3.7%. Notably, Sage invests heavily in R&D with expenditures reaching £180M last year, driving innovation within its Sage Business Cloud portfolio which saw a revenue surge to £1.74B for nine months ending June 2024.

Where To Now?

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com