The United Kingdom’s stock market has been experiencing some turbulence, with the FTSE 100 and FTSE 250 indices facing pressure due to weak trade data from China, which has impacted companies heavily reliant on Chinese demand. In this challenging environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and adaptability in the face of global economic uncertainties.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 20.98% | 106.13% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations across North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market capitalization of £1.33 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively. The company operates in various regions, including North America, Latin America, the UK, Europe, the Middle East, Russia, Africa, and Asia.

Despite recent challenges, Genus plc demonstrates resilience with a projected annual revenue growth of 4.1%, outpacing the UK market average of 3.7%. This growth is particularly noteworthy given the broader context of a -3% decline in sales year-over-year to GBP 668.8 million for FY2024. The firm’s commitment to innovation is evident from its R&D spending, crucial for staying competitive in biotechnology—a sector where rapid advancements are common. Moreover, Genus is expected to see an impressive earnings surge by 39.4% annually, significantly higher than the market forecast of 14.3%. However, it’s important to note that last year’s net profit margin dipped to 1.2% from a healthier 4.8%, partly due to a substantial one-off loss of £47.4 million affecting financial outcomes.

Looking ahead, while immediate financials reflect some volatility—underscored by the recent dividend affirmation at last year’s level and lower basic earnings per share—Genus’s strategic focus on enhancing R&D capabilities positions it well for future growth within its sector.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market capitalization of £537.09 million.

Operations: NCC Group focuses on cyber security and software resilience, generating £258.50 million from Cyber Security and £65.90 million from Escrow services. The company’s cost structure and profit margins are not specified in the provided data, but these revenue streams highlight its core business activities across multiple regions.

NCC Group’s recent inclusion in the FTSE 250 and FTSE 350 indices underscores its growing presence in the tech sector, despite current unprofitability. With an anticipated revenue growth of 4.5% per year, NCC is outpacing the UK market average of 3.7%. The firm is also poised for significant earnings expansion, with forecasts suggesting an 87.4% annual increase as it moves towards profitability over the next three years. This growth trajectory is supported by strategic investments in R&D, crucial for maintaining competitive edge in cybersecurity solutions—a field where innovation determines market leadership.

Simply Wall St Growth Rating: ★★★★★☆

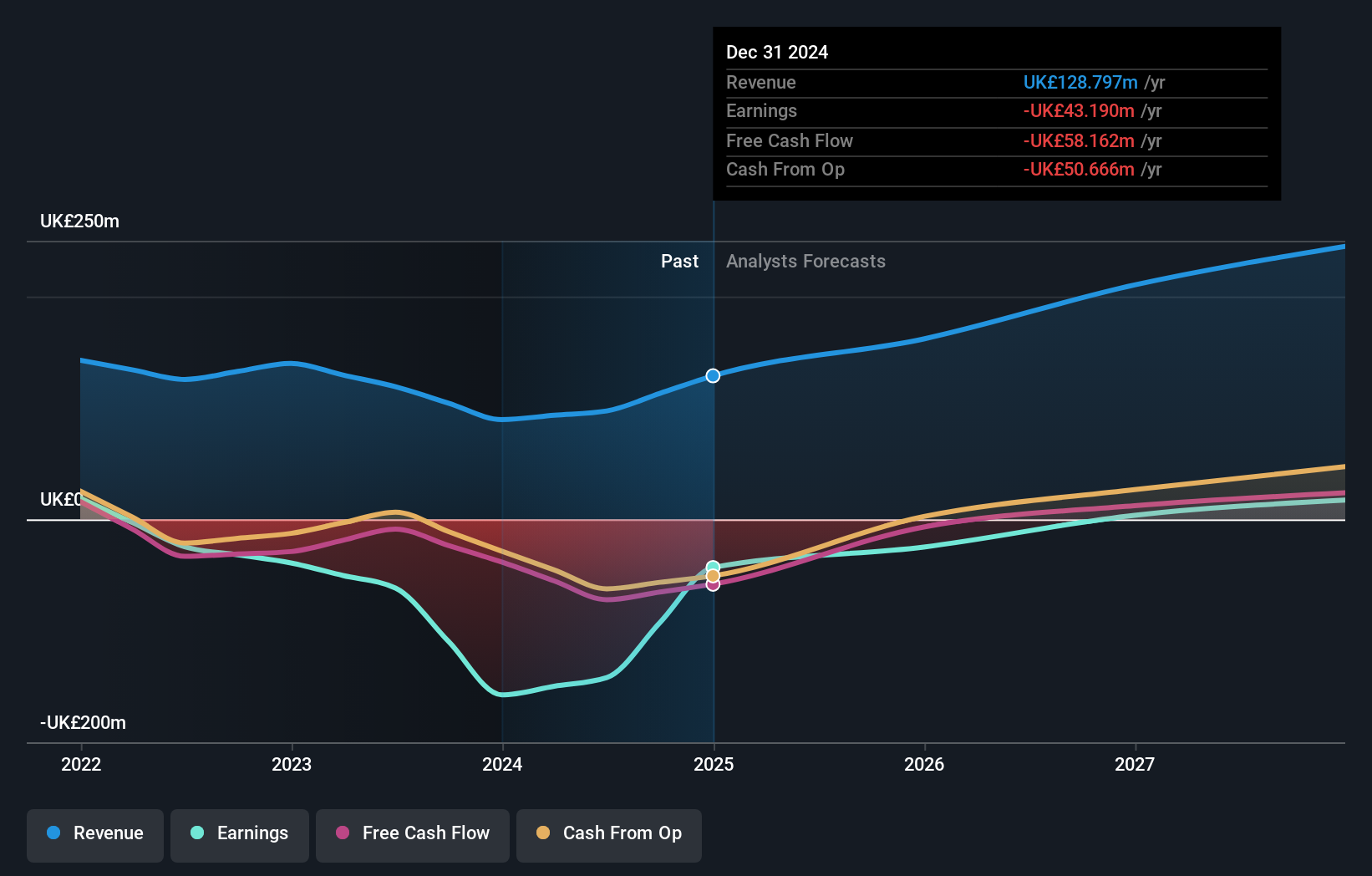

Overview: Oxford Biomedica plc is a contract development and manufacturing organization dedicated to delivering therapies globally, with a market capitalization of £400.30 million.

Operations: Oxford Biomedica generates revenue primarily from its platform segment, which contributed £97.24 million. The company operates as a contract development and manufacturing organization, focusing on delivering therapies to patients worldwide.

Oxford Biomedica, amidst a challenging landscape, reported a significant reduction in net loss to £32.49 million from £47.96 million year-over-year and saw sales increase to £50.81 million. The company’s commitment to innovation is evident in its R&D strategy, which is crucial as it navigates through unprofitability towards a forecasted profit growth of 106.1% annually over the next three years. This growth trajectory is further supported by an aggressive revenue forecast growing at 21% annually, outpacing the UK market average significantly. With new CFO Lucinda Crabtree at the helm, bringing extensive financial and biopharmaceutical experience, Oxford Biomedica is poised to strengthen its financial strategies and market position in high-growth biotechnology sectors.

Taking Advantage

- Unlock our comprehensive list of 46 UK High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com