The United Kingdom’s FTSE 100 index recently closed lower, impacted by weak trade data from China, highlighting the interconnectedness of global markets and the challenges faced by companies tied to international demand. In this environment, identifying high-growth tech stocks becomes crucial as these companies often exhibit resilience and innovation that can outperform broader market trends.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| Filtronic | 21.64% | 33.46% | ★★★★★★ |

| YouGov | 14.43% | 29.79% | ★★★★★☆ |

| STV Group | 13.43% | 47.09% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GB Group plc, with a market cap of £854.10 million, provides identity data intelligence products and services in the United Kingdom, the United States, Australia, and internationally.

Operations: GB Group plc generates revenue primarily from three segments: Fraud (£40.20 million), Identity (£156.06 million), and Location (£81.07 million). The company’s services are offered in various regions including the UK, US, and Australia.

GB Group’s revenue growth at 6.8% annually outpaces the broader UK market’s 3.7%. Despite a net loss of £48.58 million for FY24, down from £119.79 million the previous year, earnings are forecasted to surge by 92.89% per year, signaling potential profitability within three years. The company has invested heavily in R&D, allocating approximately £27 million this fiscal year to drive innovation and operational efficiency gains that could bolster future performance in the competitive software industry.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £11.02 billion.

Operations: Informa generates revenue through four main segments: Informa Tech (£426.70M), Informa Connect (£630.20M), Informa Markets (£1.67B), and Taylor & Francis (£636.70M). The company operates across various regions, including the UK, Europe, the US, and China.

Informa’s earnings are projected to grow at an impressive 21.5% annually, outpacing the UK market’s 14.3%. Despite a one-off loss of £213.5 million impacting recent financial results, the company has demonstrated resilience with a revenue growth forecast of 6.7% per year. Recent buybacks saw Informa repurchase 41,673,066 shares for £338.9 million in H1 2024, enhancing shareholder value while investing heavily in R&D to drive future innovation and operational efficiency gains across its diverse media and events segments.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Trustpilot Group plc operates an online review platform for businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £875.25 million.

Operations: Trustpilot Group plc generates revenue primarily through its online review platform, with the Internet Information Providers segment contributing $176.36 million. The company’s cost structure and profitability metrics are not detailed in the provided text.

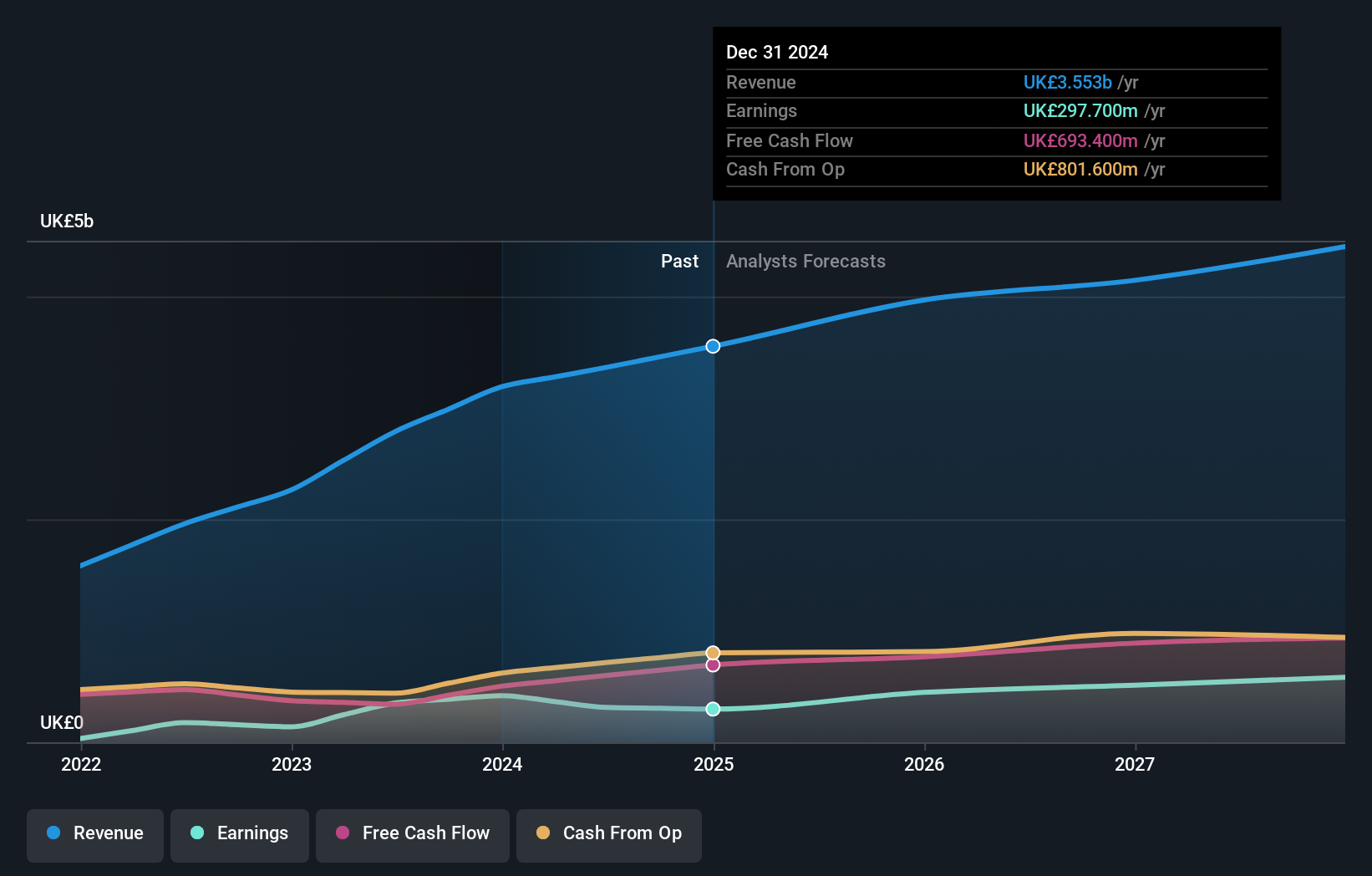

Trustpilot Group’s projected revenue growth of 16.2% annually outpaces the broader UK market’s 3.7%, signaling robust expansion potential. With earnings expected to surge by 32% per year, Trustpilot demonstrates a significant upward trajectory compared to the UK’s average of 14.3%. The company has recently turned profitable, highlighting its strategic progress in the competitive Interactive Media and Services industry, which grows at a more modest rate of 5.4%.

Make It Happen

- Click this link to deep-dive into the 47 companies within our UK High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Trustpilot Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com