Over the last 7 days, the United Kingdom market has dropped 2.3%, driven by declines in the Energy and Materials sectors of 6.2% each, although it is up 7.4% over the past year with earnings expected to grow by 14% per annum in the coming years. In this context, identifying high-growth tech stocks that can outperform despite short-term market fluctuations is crucial for investors seeking robust returns.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

| Genus | 4.24% | 39.40% | ★★★★☆☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc, with a market cap of £817.91 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc generates revenue primarily from its healthcare software segment, amounting to $189.27 million. The company focuses on developing, licensing, and supporting computer software tailored for the U.S. healthcare industry.

Craneware’s strategic alignment with Microsoft Azure is set to enhance its cloud capabilities and AI-driven solutions, fostering innovation in healthcare analytics. The company’s revenue rose by 8.2% to $189.27 million, while net income increased by 26.8% to $11.7 million for the year ending June 30, 2024. With a focus on M&A opportunities, Craneware aims to expand its customer base and expertise further. Notably, R&D expenses have been pivotal in driving these advancements; however, specific figures weren’t disclosed in recent reports.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LBG Media plc is an online media publisher with operations in the United Kingdom, Ireland, Australia, the United States, and internationally, and has a market cap of £280.17 million.

Operations: LBG Media generates revenue primarily from its online media publishing activities, amounting to £67.51 million. The company operates across multiple countries including the UK, Ireland, Australia, and the US.

LBG Media’s revenue is projected to grow at 11.7% annually, outpacing the UK market’s 3.7% growth rate. Despite a recent one-off loss of £4.2M, the company anticipates earnings growth of 43.8% per year over the next three years, significantly higher than the market average of 14.4%. R&D expenses have been instrumental in driving innovation and content diversification, although specific figures weren’t disclosed recently. The net profit margin has decreased from 8.6% to 0.9%, reflecting challenges but also potential for recovery and expansion in digital media segments.

Simply Wall St Growth Rating: ★★★★☆☆

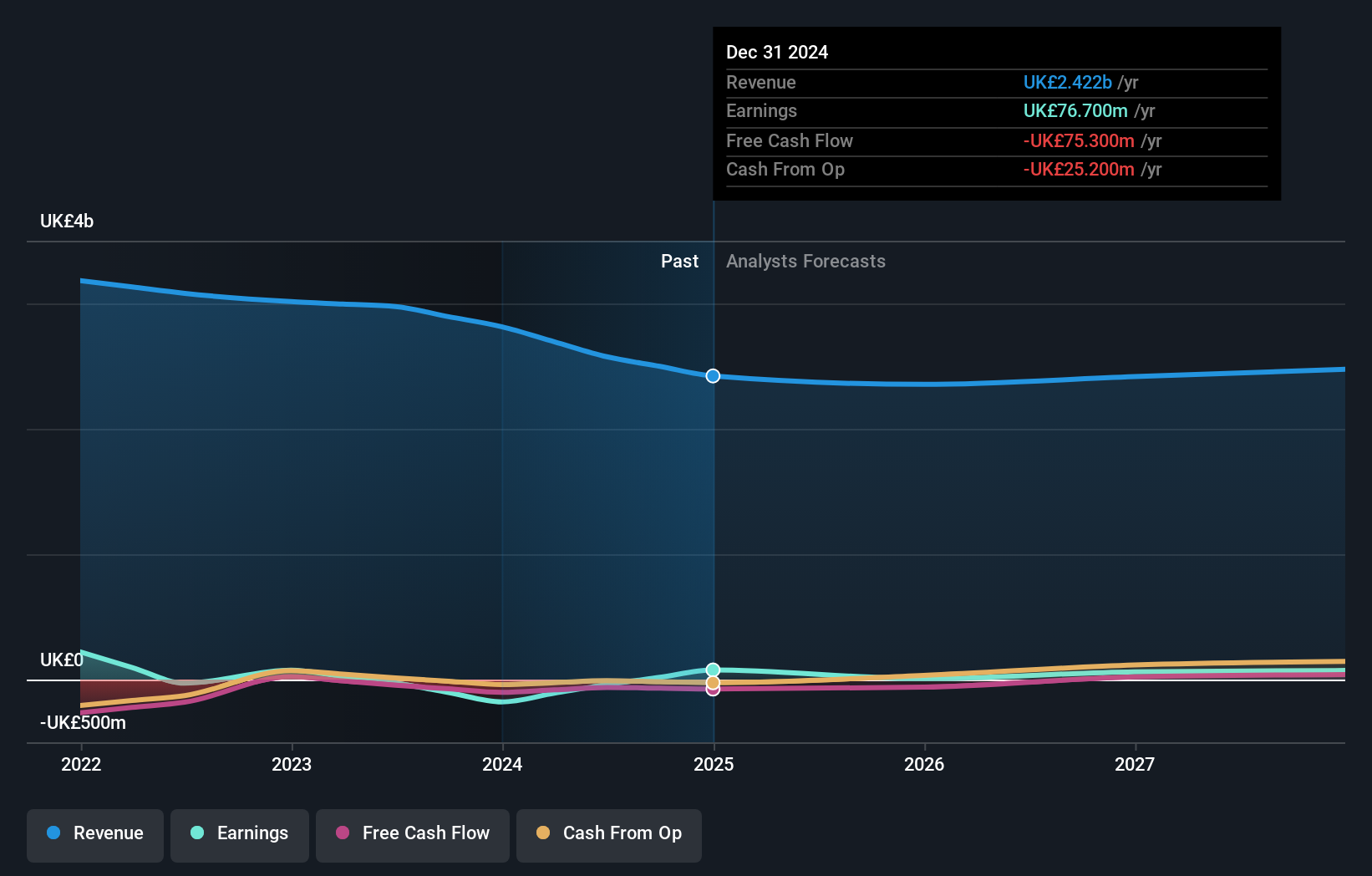

Overview: Capita plc offers consulting, digital, and software products and services to clients in both the private and public sectors in the UK and internationally, with a market cap of £309.30 million.

Operations: Capita generates revenue primarily through its two main segments: Capita Experience (£1.12 billion) and Capita Public Service (£1.49 billion). The company caters to both private and public sector clients in the UK and internationally.

Capita’s recent earnings report for H1 2024 showed a sales figure of £1.24 billion, down from £1.48 billion the previous year, yet net income turned positive at £53 million compared to a net loss of £84.4 million last year. The company is forecasted to grow its earnings by 52.09% annually over the next three years, outpacing market averages significantly. Capita’s renewed contract with the Cabinet Office for administering the Royal Mail Statutory Pension Scheme highlights its strong client relationships and reliance on advanced digital solutions like Microsoft Dynamics, ensuring sustained service quality and operational efficiency.

Turning Ideas Into Actions

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com