The UK market has been experiencing turbulence, with the FTSE 100 closing lower due to weak trade data from China, reflecting broader global economic uncertainties. In such a climate, identifying high-growth tech stocks requires focusing on companies with robust innovation and strong market positioning that can withstand external pressures.

Top 10 High Growth Tech Companies In The United Kingdom

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Filtronic |

21.64% |

33.46% |

★★★★★★ |

|

YouGov |

14.30% |

29.79% |

★★★★★☆ |

|

STV Group |

13.43% |

47.09% |

★★★★★☆ |

|

Trustpilot Group |

16.23% |

31.98% |

★★★★★☆ |

|

Redcentric |

4.89% |

63.79% |

★★★★★☆ |

|

LungLife AI |

83.65% |

88.65% |

★★★★★☆ |

|

IQGeo Group |

11.49% |

63.61% |

★★★★★☆ |

|

Vinanz |

113.60% |

125.86% |

★★★★★☆ |

|

Beeks Financial Cloud Group |

24.63% |

57.95% |

★★★★★☆ |

|

Seeing Machines |

24.29% |

94.35% |

★★★★★☆ |

Click here to see the full list of 50 stocks from our UK High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★☆☆

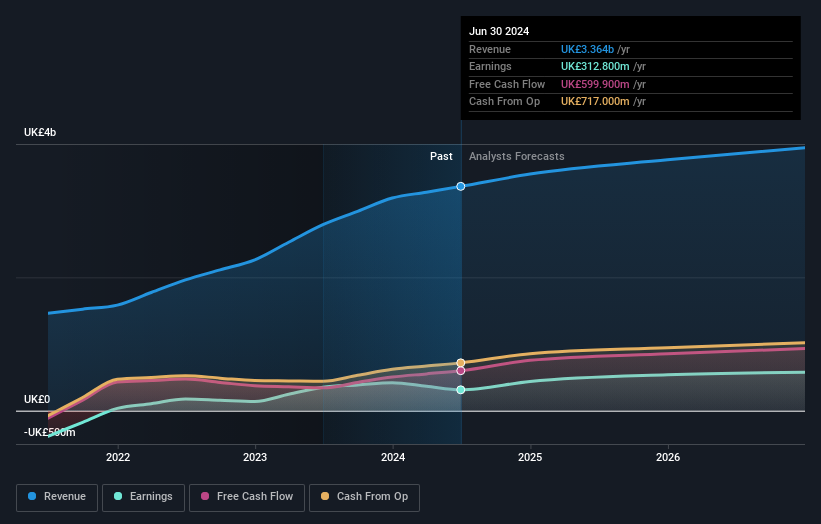

Overview: Informa plc operates as an international events, digital services, and academic research company with a market cap of £10.85 billion.

Operations: Informa generates revenue through four main segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company’s diverse portfolio spans international events, digital services, and academic research across various global regions including the UK, Continental Europe, the US, and China.

Informa’s earnings are forecast to grow 21.5% annually, significantly outpacing the UK market’s 14.3%. Despite a challenging year with a £213.5M one-off loss impacting financial results, revenue is expected to grow at 6.3% per year, faster than the UK’s average of 3.7%. The company has invested heavily in R&D, with expenditures contributing to innovative solutions and services across its media and event segments. Recent buybacks totaling £1.30B for 13.47% of shares indicate strong confidence in future prospects.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Sage Group plc, with a market cap of £10.15 billion, provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally.

Operations: Sage Group generates revenue primarily from technology solutions and services for small and medium businesses, with significant contributions from North America (£1.01 billion) and Europe (£595 million). The company also operates in the United Kingdom & Ireland, contributing £488 million to its total revenue.

Sage Group’s revenue is forecast to grow at 8.1% annually, outpacing the UK market’s 3.7%. The company reported a 28.4% earnings growth over the past year, driven by innovations in its Sage Business Cloud portfolio and strategic partnerships like VoPay for enhanced payroll functionalities. With R&D expenses contributing significantly to advancements, including £85 million in recent quarters, Sage’s commitment to innovation is evident. Earnings are projected to rise by 14.4% annually, reflecting robust future prospects despite high debt levels.

Simply Wall St Growth Rating: ★★★★★☆

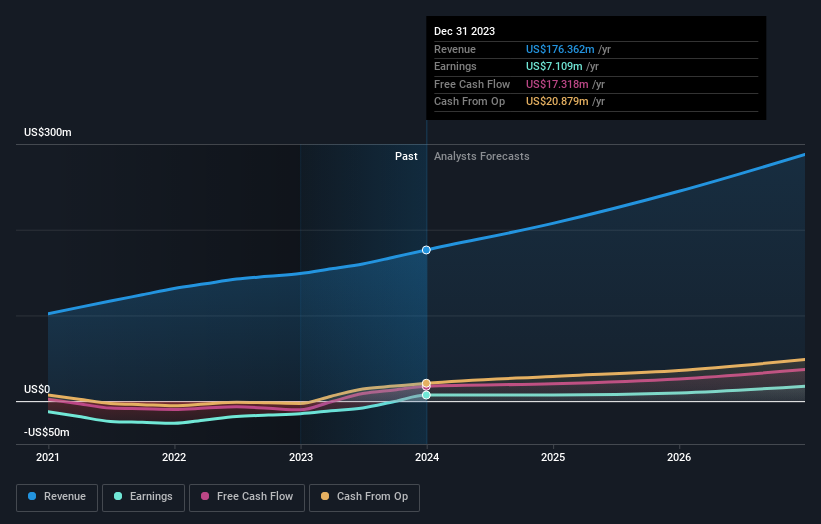

Overview: Trustpilot Group plc develops and hosts an online review platform for businesses and consumers across the United Kingdom, North America, Europe, and internationally, with a market cap of £823.62 million.

Operations: Trustpilot Group plc generates revenue primarily through its online review platform, which serves businesses and consumers globally. The company reported $176.36 million in revenue from its Internet Information Providers segment.

Trustpilot Group’s earnings are projected to grow at an impressive 32% annually, significantly outpacing the UK market’s average of 14.3%. With a revenue growth forecast of 16.2% per year, Trustpilot is well-positioned within the Interactive Media and Services industry. The company has recently become profitable and boasts a high return on equity forecasted at 37.6% in three years. Recent M&A rumors involving Trafalgar Acquisition S.a.r.l.’s intention to sell up to approximately 12.5 million shares could impact investor sentiment in the short term but underscores institutional interest in Trustpilot’s potential.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:INF LSE:SGE and LSE:TRST.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com