The market in the United Kingdom has climbed 1.1% in the last 7 days and is up 6.9% over the past 12 months, with earnings expected to grow by 14% per annum over the next few years. In this favorable environment, identifying high growth tech stocks that align with these positive trends can be crucial for investors looking to capitalize on future opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

Click here to see the full list of 46 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

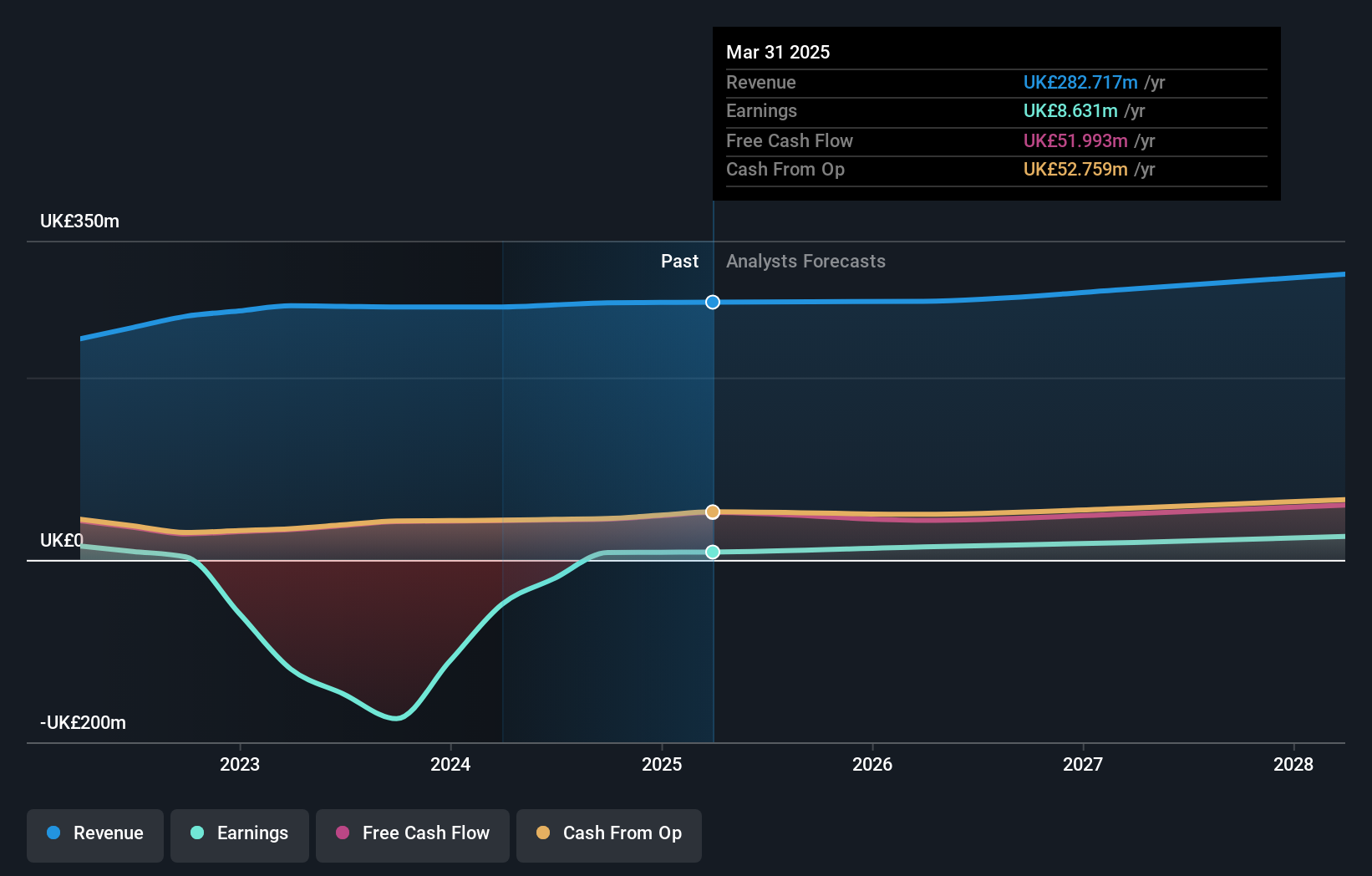

Overview: Craneware plc, with a market cap of £803.93 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware plc generates revenue primarily from its healthcare software segment, which brought in $189.27 million. The company focuses on developing, licensing, and supporting software solutions tailored for the U.S. healthcare industry.

Craneware’s strategic maneuvers in the tech sector, particularly its collaboration with Microsoft and aggressive share repurchase program, underscore its commitment to growth and market expansion. The company has recently reported a robust earnings growth of 25.6% per year, outpacing the UK market average of 14.2%, with revenue projections set to exceed the market trend at 8.2% annually. Notably, Craneware’s R&D investments have been pivotal, enhancing its product offerings on platforms like Microsoft Azure, which not only broadens its technological capabilities but also ensures deeper market penetration through high-profile partnerships and advanced AI applications. This approach is expected to sustain Craneware’s competitive edge by fostering innovation and customer engagement in a rapidly evolving digital landscape.

Simply Wall St Growth Rating: ★★★★☆☆

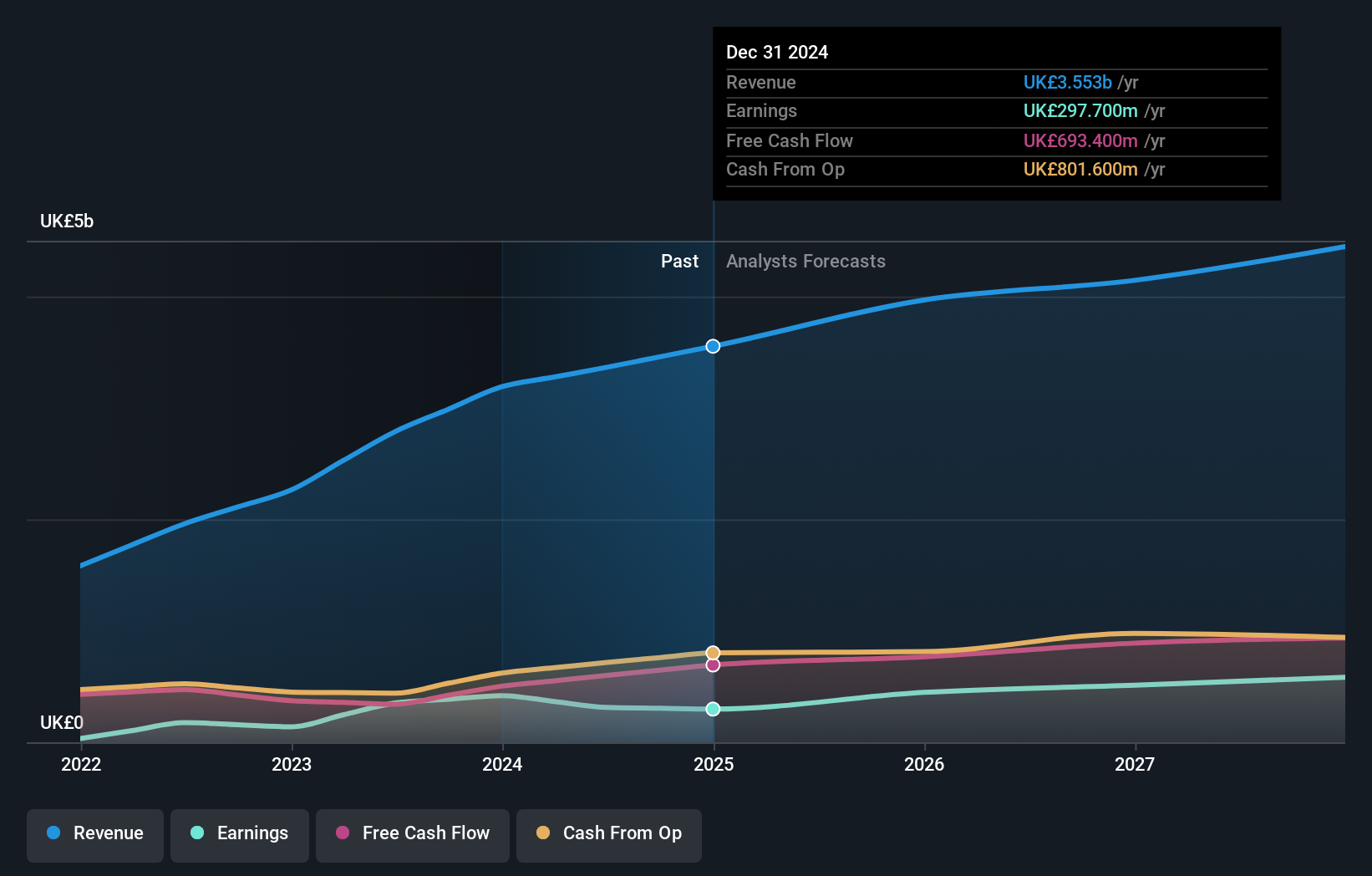

Overview: GB Group plc, along with its subsidiaries, offers identity data intelligence products and services across the United Kingdom, the United States, Australia, and internationally with a market cap of £806.76 million.

Operations: The company generates revenue through three primary segments: Fraud (£40.20 million), Identity (£156.06 million), and Location (£81.07 million). With a market cap of £806.76 million, it operates internationally, including in the UK, US, and Australia.

GB Group, despite its current unprofitability, is positioned for significant transformation with expected earnings growth at an impressive 92.9% annually. This anticipated surge contrasts starkly with the broader UK software industry’s growth rate of 19.9%. The company’s commitment to innovation is evident from its R&D expenditures, which are critical in fostering advancements and maintaining competitiveness in the fast-evolving tech landscape. Moreover, GB Group’s revenue is projected to increase by 6.8% per year, outpacing the UK market average of 3.7%, signaling potential for substantial market share expansion as it moves towards profitability over the next three years. These developments come on the heels of a recent dividend increase to 4.20 pence announced at their AGM, underscoring a positive outlook from management about future financial health and shareholder returns.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Informa plc operates as an international events, digital services, and academic research company with a market cap of £11.23 billion.

Operations: Informa plc generates revenue through its four main segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company operates in the UK, Continental Europe, the US, China, and internationally.

Despite a challenging year with a 11.3% dip in earnings, Informa is poised for recovery, forecasting robust annual earnings growth of 21.6%. This optimistic outlook is bolstered by significant R&D investments, crucial for driving innovation and staying competitive in the tech sector. Additionally, the company’s revenue growth projection of 6.8% annually outstrips the UK market average of 3.7%, indicating potential market share gains. Recent strategic moves include executive board changes and substantial share repurchases totaling £1.3 billion, reflecting confidence in future growth and commitment to shareholder value.

Summing It All Up

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com