Analysis by search marketing platform Salience revealed that Sports Direct leads the online footwear industry, boasting a 21% increase in visibility to 187,700 over the past year.

JD Sports secured second place with a 28% rise in visibility from 63,453 to 81,425.

UK footwear retailer Schuh ranked third with an 8% increase in visibility year-on-year to 71,172.

Meanwhile, footwear brand Office reportedly saw a 2% drop in visibility, leading to its fourth position on the list with 70,488 searches.

US Sportswear giant NIKE occupied the fifth spot and saw a 9% decline in visibility with total visibility of 40,816.

However, the report highlighted that these brands stand out as “ones to watch,” experiencing the most significant growth in the market and demonstrating the success of their strategies in enhancing “brand awareness and boosting customer numbers.”

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Brett Janes, managing director at Salience, explained: “Online visibility is a great way of measuring the brand awareness of any company operating within a highly competitive industry. The 5% increase in search for this sector highlights the growing demand for online footwear brands and the opportunity for brands to implement a solid marketing strategy for their website to compete within the e-commerce market.”

The report reviewed brands against 11 performance indicators, including year-on-year visibility, search volume trends, and brand awareness.

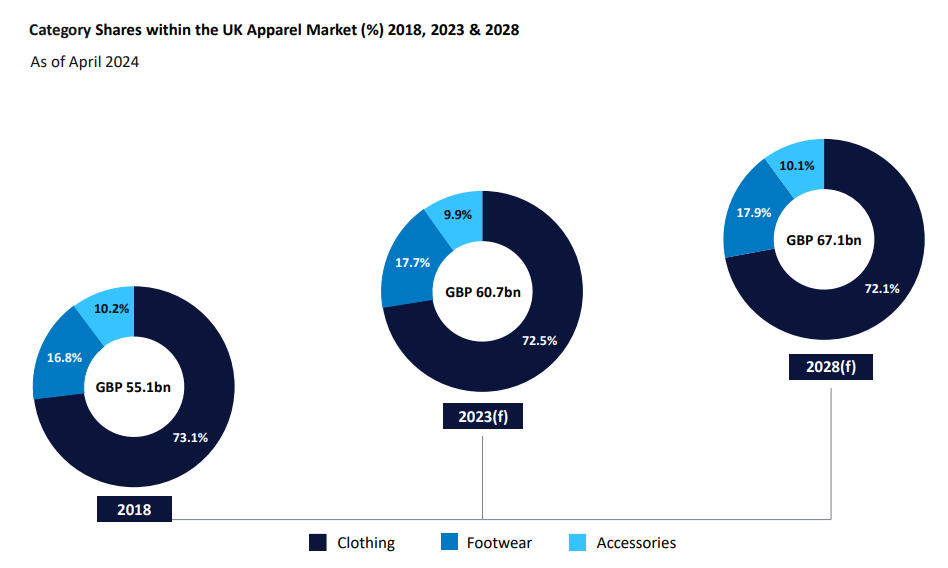

GlobalData’s recent Apparel market in the UK to 2028 report unveiled that footwear is expected to outperform between 2023 and 2028, with its share rising by 0.2ppts to 17.9%.

The report noted that growth in the sector has been supported by the continued popularity of trainers, as consumers’ interest in health and wellness remains strong post-pandemic. Plus, trainers continue to be regarded as superior value for money.