In the last week, the United Kingdom market has stayed flat but is up 5.3% over the past year, with earnings expected to grow by 14% per annum over the next few years. In this promising environment, identifying high-growth tech stocks like IQGeo Group and two others can be crucial for capitalizing on future opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

| IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★★☆

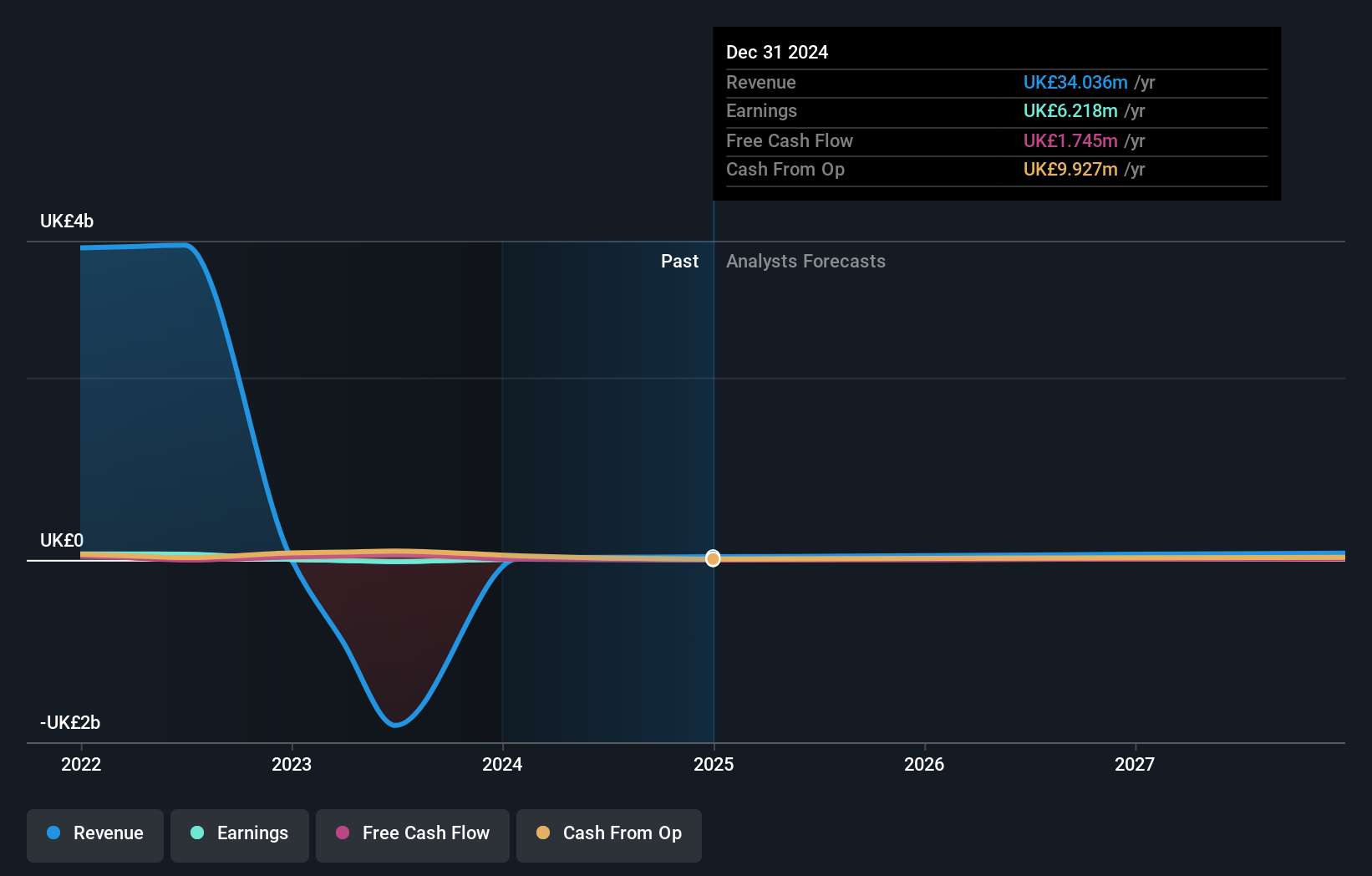

Overview: IQGeo Group plc provides geospatial software solutions for telecom and utility network operators across various countries, with a market cap of £294.90 million.

Operations: IQGeo Group plc, along with its subsidiaries, offers geospatial software solutions primarily to telecom and utility network operators in multiple countries. The company’s revenue from geospatial services stands at £44.49 million.

IQGeo Group has recently transitioned to profitability, a significant milestone that aligns with its robust earnings forecast of 63.6% annual growth, outpacing the UK market average of 14.2%. This leap into profitability underscores the company’s effective strategy and operational efficiency in a competitive tech landscape. Despite this rapid earnings growth, revenue projections are more conservative at 11.5% annually, slightly below the high-growth threshold but still ahead of the broader UK market’s 3.7% pace.

The company’s focus on innovation is evident from its R&D investments which have strategically bolstered its software solutions portfolio, crucial for sustaining long-term growth in the tech sector. Moreover, IQGeo’s recent acquisition agreement and upcoming delisting suggest strategic shifts that could further influence its market position and financial health. These developments reflect a dynamic approach to scaling operations and adapting to evolving industry demands while maintaining a strong focus on core technological advancements.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Keywords Studios plc offers a range of creative and technical services to the global video game industry, with a market cap of approximately £1.95 billion.

Operations: Keywords Studios plc generates revenue through three primary segments: Create (€365.56 million), Engage (€180.43 million), and Globalize (€261.61 million). The company provides a comprehensive suite of services to the video game industry, including creative content production, player engagement strategies, and localization/globalization solutions.

Despite Keywords Studios’ recent financial struggles, evidenced by a net loss of EUR 30.88 million in the first half of 2024, its revenue growth outlook remains promising at an expected 10.2% annually, outpacing the UK market average of 3.7%. This growth trajectory is bolstered by significant R&D investments, aligning with industry trends towards enhanced digital and interactive media solutions. The company’s strategic direction is further underscored by its pending acquisition and delisting plans, which could reshape its operational structure and market approach. These moves indicate a proactive strategy to stabilize and potentially enhance its market position in the evolving tech landscape.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry in the United Kingdom and internationally, with a market cap of £296.44 million.

Operations: Pinewood Technologies Group PLC generates revenue primarily from its software solutions, amounting to £22.62 million. The company focuses on providing cloud-based dealer management software to the automotive sector both domestically and internationally.

Pinewood Technologies Group, amidst a challenging landscape with a recent -83.2% earnings slump, still shows promise with its revenue forecast to climb by 16.9% annually, outstripping the UK’s average growth of 3.7%. This resilience is partly due to their strategic R&D allocation which not only aligns with but also propels sector advancements in software solutions. Additionally, their expected earnings surge at 23.2% per year offers a glimpse into potential recovery and sector leadership. The recent auditor change underscores a strategic reshuffle possibly aimed at bolstering governance and operational efficiency as they navigate these turbulent waters.

Turning Ideas Into Actions

- Take a closer look at our UK High Growth Tech and AI Stocks list of 47 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com