As the UK economy shows signs of recovery and investors digest recent GDP figures, the FTSE 100’s positive trajectory reflects a cautiously optimistic outlook in London’s financial markets. In such an environment, identifying stocks that appear undervalued relative to their intrinsic worth could offer potential opportunities for investors seeking value in a recovering market.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kier Group (LSE:KIE) | £1.45 | £2.82 | 48.6% |

| WPP (LSE:WPP) | £7.272 | £14.01 | 48.1% |

| LSL Property Services (LSE:LSL) | £3.29 | £6.49 | 49.3% |

| Auction Technology Group (LSE:ATG) | £4.77 | £9.22 | 48.2% |

| Loungers (AIM:LGRS) | £2.86 | £5.55 | 48.5% |

| Velocity Composites (AIM:VEL) | £0.415 | £0.80 | 48.4% |

| Accsys Technologies (AIM:AXS) | £0.55 | £1.07 | 48.4% |

| Ricardo (LSE:RCDO) | £4.93 | £9.51 | 48.2% |

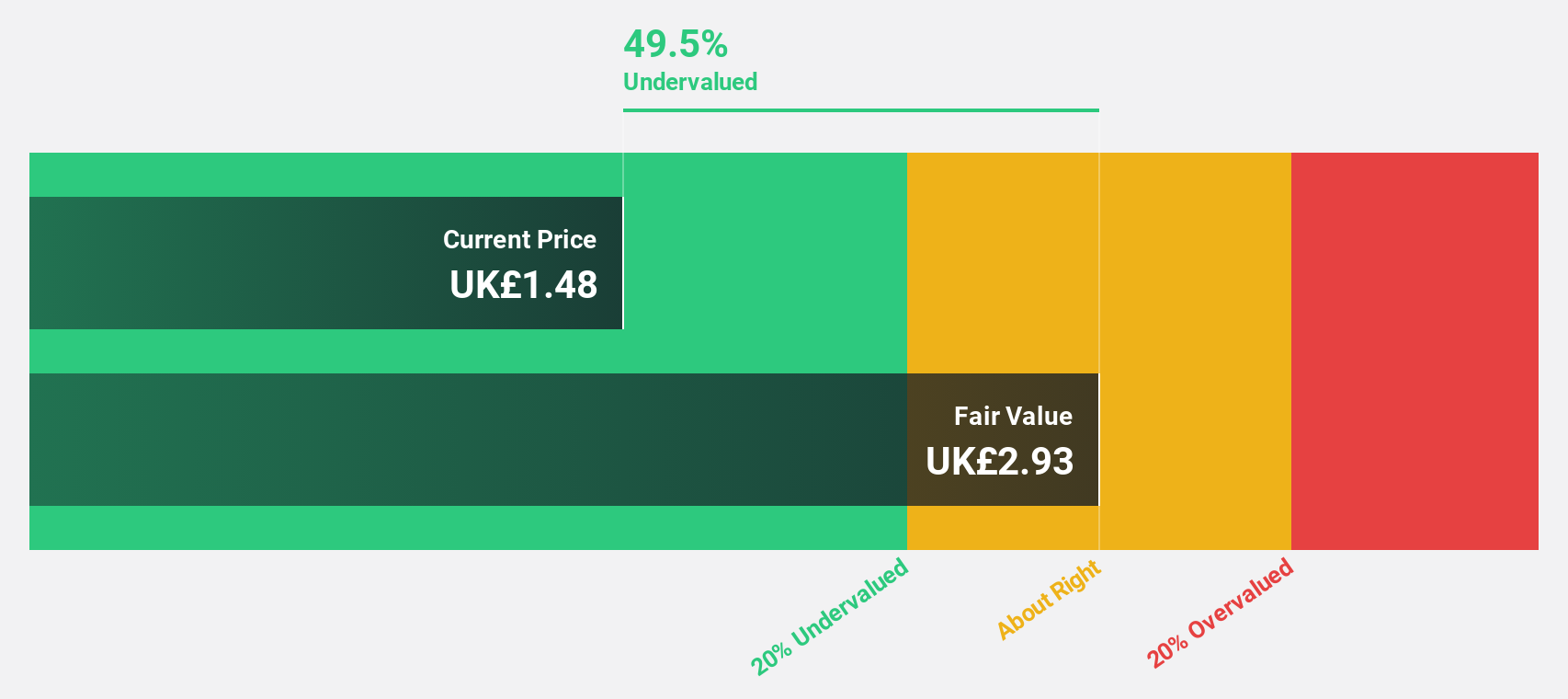

| Hostelworld Group (LSE:HSW) | £1.53 | £2.93 | 47.7% |

| M&C Saatchi (AIM:SAA) | £2.05 | £3.98 | 48.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Overview: AstraZeneca PLC is a biopharmaceutical company engaged in the discovery, development, manufacture, and commercialization of prescription medicines, with a market capitalization of approximately £187.24 billion.

Operations: The company’s revenue from biopharmaceuticals totaled $47.61 billion.

Estimated Discount To Fair Value: 39.2%

AstraZeneca, a prominent player in the pharmaceutical industry, demonstrates potential underappreciation based on its cash flow metrics relative to market valuation. Recent strategic developments include a partnership with Aptamer Group plc to enhance siRNA delivery technologies, potentially boosting AstraZeneca’s competitive edge in biotechnology. Moreover, regulatory advancements for its oncology products like Imfinzi and Lynparza in the EU could promise future revenue streams. However, investors should consider the inherent risks of drug development and market acceptance. These factors collectively suggest that AstraZeneca’s current market pricing may not fully reflect its future cash flow generation capabilities from these innovations and approvals.

Overview: The Gym Group plc operates a chain of fitness centers across the United Kingdom and has a market capitalization of approximately £237.66 million.

Operations: The company generates £204 million from operating health and fitness centers.

Estimated Discount To Fair Value: 34.9%

Gym Group, valued at £1.33, trades below its estimated fair value of £2.04, indicating a significant undervaluation based on discounted cash flows. The company’s earnings are expected to grow robustly by 91.05% annually, outpacing the UK market forecast of 3.5%. Despite challenges in achieving high Return on Equity, which is projected at a modest 1.3% in three years, Gym Group’s strategic focus on ESG could enhance its growth trajectory as outlined in recent special calls and upcoming financial disclosures scheduled for July 10, 2024.

Overview: Supermarket Income REIT plc (LSE: SUPR) is a UK-based real estate investment trust focusing on grocery properties, with a market capitalization of approximately £0.94 billion.

Operations: The company generates revenue primarily through its real estate investment segment, totaling £106.29 million.

Estimated Discount To Fair Value: 13.4%

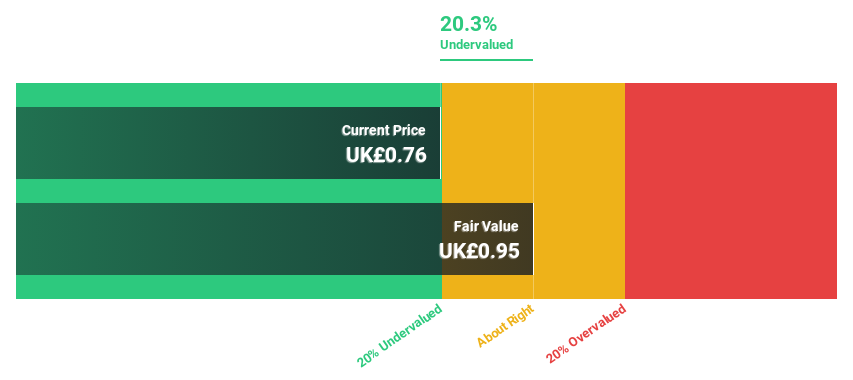

Supermarket Income REIT, priced at £0.76, is trading under its fair value of £0.87, reflecting a modest undervaluation in the UK market based on discounted cash flows. The company’s earnings are anticipated to surge by 90.24% annually, significantly outperforming the UK market growth expectation of 12.5%. However, concerns exist regarding unstable dividend records and debt not being well covered by operating cash flow, which could impact financial stability. Recent affirmations of dividends align with yearly targets, supporting short-term income expectations despite underlying financial challenges.

Taking Advantage

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re helping make it simple.

Find out whether AstraZeneca is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com