The United Kingdom market has shown resilience with a 7.4% increase over the past year, despite a flat performance last week while the Materials sector gained 5.5%. With earnings forecast to grow by 14% annually, identifying high growth tech stocks that can capitalize on this momentum is crucial for investors looking to maximize their returns in September 2024.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| STV Group | 13.15% | 46.78% | ★★★★★☆ |

| Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

| YouGov | 14.29% | 29.79% | ★★★★★☆ |

| Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

| Redcentric | 4.89% | 63.79% | ★★★★★☆ |

| Windar Photonics | 63.60% | 126.92% | ★★★★★☆ |

| LungLife AI | 100.61% | 100.97% | ★★★★★☆ |

| Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

| Oxford Biomedica | 20.98% | 106.13% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market cap of approximately £1.25 billion.

Operations: Genus plc generates revenue primarily through its Genus ABS and Genus PIC segments, contributing £314.90 million and £352.50 million respectively. The company operates in various regions including North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia.

Despite a challenging year with earnings dropping by 76.3%, Genus plc’s future looks promising with an expected annual profit growth of 39.4%. This contrasts starkly with the broader Biotechs industry, which saw an average decline of 22.6%. The company’s commitment to innovation is evident from its R&D spending trends, aligning closely with its strategic focus on enhancing genetic capabilities in agriculture. With revenue projected to grow at 4.1% annually, slightly outpacing the UK market forecast of 3.7%, and a stable dividend proposal mirroring last year’s, Genus is poised for recovery and growth amidst industry headwinds.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Oxford Biomedica plc, with a market cap of £389.76 million, is a contract development and manufacturing organization dedicated to delivering therapies globally.

Operations: Oxford Biomedica plc specializes in the development and manufacturing of therapies for global markets. The company generates revenue through its contract services, focusing on delivering innovative treatments to patients worldwide.

Oxford Biomedica, amid a robust tech landscape, is steering towards profitability with an anticipated earnings growth of 106.1% annually. This projection aligns with their strategic R&D investments, which are not just substantial but pivotal to their long-term trajectory—evidenced by a forecasted revenue jump from £126 million to £134 million in 2024 alone. Their recent executive reshuffles, including the appointment of Lucinda Crabtree as CFO, underscore a strengthened leadership poised to navigate through the complexities of biotech innovations and market demands effectively.

Simply Wall St Growth Rating: ★★★★☆☆

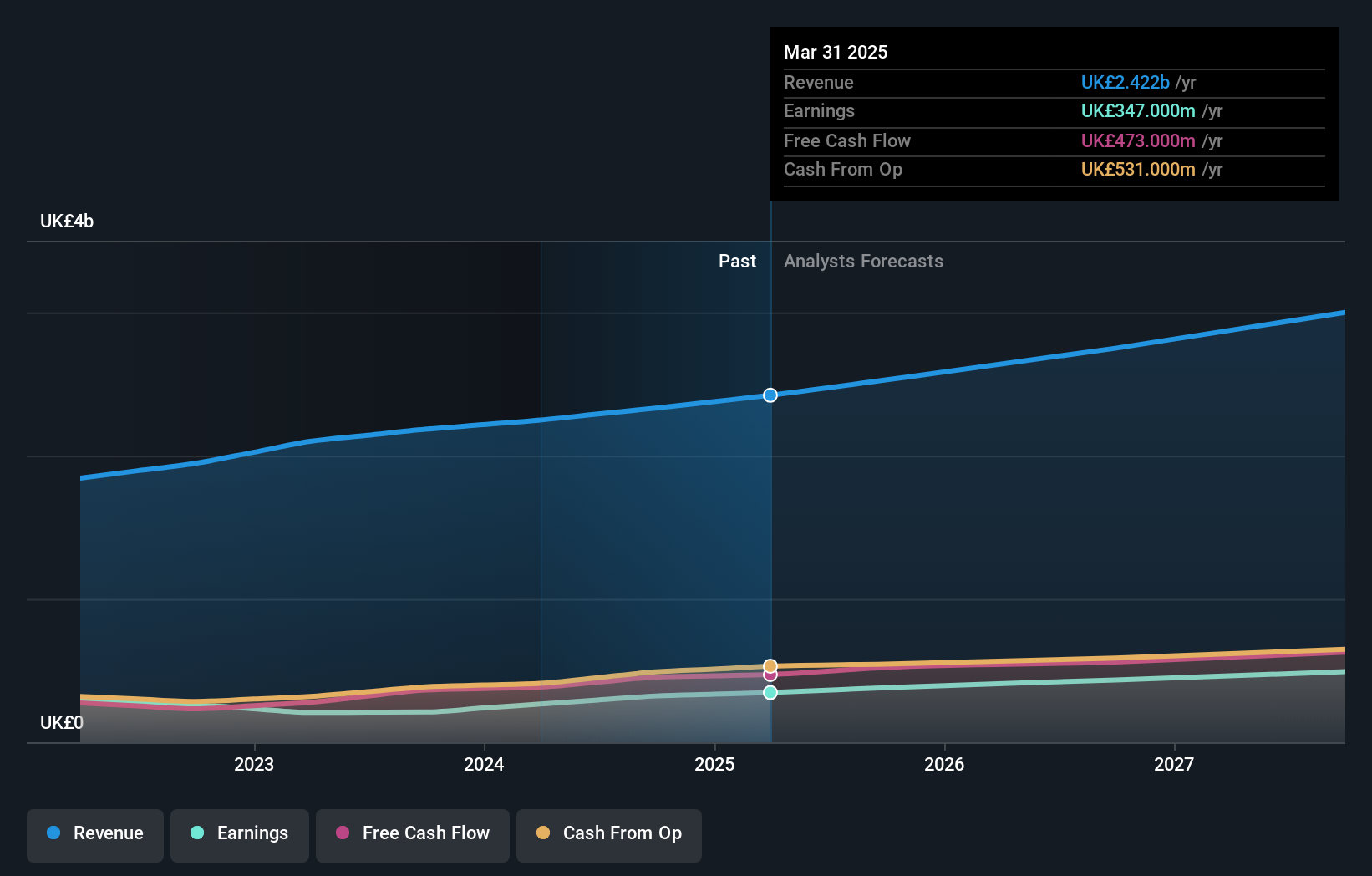

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally, with a market cap of £10.12 billion.

Operations: Sage Group generates revenue primarily from Europe (£595 million), North America (£1.01 billion), and the United Kingdom & Ireland (£488 million). The company focuses on providing technology solutions and services tailored for small and medium businesses across these regions.

Sage Group, with a strategic emphasis on enhancing its software solutions through partnerships like the one with VoPay, is significantly improving operational efficiencies for SMBs. This collaboration not only streamlines payroll processes by integrating advanced payment technologies but also addresses major industry pain points such as manual tasks and security risks. With recent financial performances showing a 7.9% revenue growth to £1.737 billion and earnings projected to rise by 15.1% annually, Sage is aligning its offerings to meet the evolving demands of digital finance management—evidenced further by their robust R&D commitment which bolsters their competitive edge in the tech-driven business landscape.

Where To Now?

- Delve into our full catalog of 47 UK High Growth Tech and AI Stocks here.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com